The Hot Asian Money (HAM) story just won’t go away. I’ve already addressed this issue twice in prior posts. But it’s like a bad fart….it just seems to linger.

As I have said before, I don’t disagree that there are rich foreign investors buying Vancouver real estate and that it has had some direct and indirect effects in buoying prices, but I’m highly skeptical that it will save a Vancouver housing market that is currently considered among the most unaffordable in the world.

Today we see that the Globe ran an interesting article exploring this very topic:

Is Vancouver in a real estate bubble?

(Hat tip to Ray for emailing me this story….thanks)

The article is an overall interesting read and should stand as a case study on how to write an investigative journalism piece relying almost exclusively on anecdotes from sources of questionable reliability. It’s impressive, really.

Despite the author being a frequent contributor to Vancouver Magazine (suggesting he is likely a resident of Van Town and perhaps has a slight bias) to his credit he at least tries to present a balanced argument. As with virtually all mainstream media articles though, I question why the primary data sources are realtors. Is there no one with an arguably more balanced perspective?

Let’s see what the article actually had to say. I really liked this quote:

“When wealthy Chinese immigrants buy property in Vancouver—and they utterly dominate the top end of the market—they’re actually buying a form of insurance. What the federal and provincial governments get out of these newly minted Canadians turns out to be a modern form of the infamous head tax that was imposed on Chinese migrants in the 19th century. And what Vancouver gets is an economy that boasts a lot of froth, and not much substance. From all three angles, it feels like a relationship that is built not so much on Commitment as on enjoying the good times while they last.“

I think the last sentence astutely summarizes the broader problem. If this ‘rich Asian’ dynamic is in fact true, it implies that there are structural issues in economic growth for the city of Vancouver. Further to that point, it implies a tremendous amount of vulnerability to policy changes by either government (like the significant recent changes to investor immigrant laws), as well as economic instability in China.

The notion that these rich Chinese investors ‘utterly dominate’ the high end market is bandied about often, though only as a passing anecdote. Though it certainly is possible that this is happening, I have yet to see convincing stats proving that this is in fact the case.

“The buyer will likely be from China as well: Lui estimates that up to 80% of recent sales in this price range have been going to buyers from mainland China.”

She estimates. Hmmmm. This is what journalistic integrity amounts to today?

Let me advance this thought: Could it be that Manyee Lui’s experience is vastly different that most other realtors? Manyee Lui is fluent in English, Cantonese, and Mandarin and clearly targets this buyer group as explained on her website. It’s not a stretch to assume that she also receives a highly disproportionate number of Chinese buyers. Come on….Who is a Chinese investor going to use as a realtor: someone who speaks their language and understands their culture, or other realtors like this dude?

So is it possible that this is her experience with rich Chinese investors in the high-end market? Of course. Is it a stretch to assume that this is the case for all home sales in this market segment? Big time!

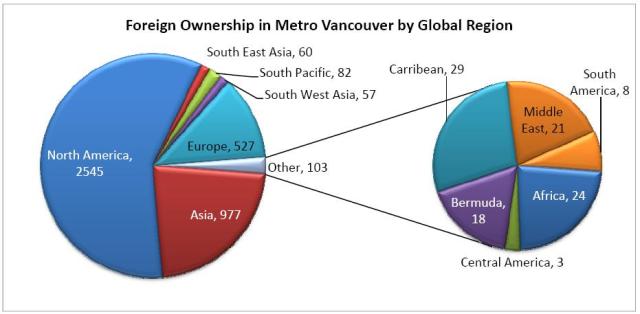

But let’s not let it rest there. The 2010 Landcor report on the Vancouver housing market indicated that a total of 977 properties in the Metro Vancouver area are owned by non-residents from Asia. This number also includes residents from Australia, Indonesia, Japan, the Philipines, etc, not just China and Hong Kong.

Yet in 2009, the last year of full sales data, the Greater Vancouver Real Estate Board reported 35,669 total sales. So even if all 977 owners purchased their properties in the same year, it would only represent 2.7% of the total sales volume.

Now this only documents foreign ownership of Vancouver homes. It doesn’t count those who obtain citizenship through Canada’s Business Immigration Program. What total volume of sales might they make up?

The article notes that Vancouver gets about half of the annual 10,000 or so people who immigrate under the entrepreneur and investor classes. Simple math tells us that this number is approximately 5000 people (not 5000 households).

The article outlines a typical scenario in which, “one of the parents, usually the wife, moves to Canada with the children while the husband stays in Asia, coming for visits when he can.” So the number of total investor immigrants represents 2500 households at best! When this number is compared against the total annual sales volume for the Greater Vancouver area, we find that it accounts for at best 7% of total sales! That puts things in a whole different light, doesn’t it? As it turns out, rich Asian investors undoubtedly account for less than 10% of the total sales volume, and I would suggest that it is likely significantly less than that given the propensity of many Asian cultures to live in extended family (multigenerational) households.

Now given that the entire article is premised on the argument that there are lots of rich Chinese investors coming to Vancouver to buy extremely expensive houses, the above data calls this foundational assertion into question. In fact it leaves it in a smoldering pile.

From here the article goes on to outline a series of anecdotes and some very old data largely intended to disprove the bubble hypothesis. It then waders aimlessly for several paragraphs as it explains how the new Asian population presents some unconventional business opportunities. So an article that starts out discussing real estate ends up discussing random emerging business opportunities, largely ignoring the question in its title.

To be fair, this article is an interesting examination of the unsustainable economy of Vancouver and serves to highlight the sociocultural factors that drive Chinese immigrants to buy houses to their own financial detriment. But it is long on anecdotes from arguably biased sources and extremely weak on substantial facts. At best, the Vancouver real estate market is relying on the continued influx of a relatively small group of wealthy immigrants to purchase their massively overpriced real estate. At worst, it’s relying on the continued perpetuation of a tired old story to keep its own residents piling on unservicable debts. Either way, I’m far from convinced of the sustainability of this present dynamic.

Cheers,

Ben

Excellent and fair rebuttal/comment on your part Ben. So rich immigrants are not and can not (based on the available information) be propping up the whole market. So, for arguments sake, let’s say they are propping up the high end of the market. How would that trickle down to and be a factor in the mid and lower range? If one end of the market depends on rich immigrants and the other on local buyers who are working residents of the city can the market then bifurcate into two distinct entities? If effect I’m saying I don’t see the mechanism for a strong upper end market to pull along the lower end especially when that low end is so far into unaffordability. I suppose for a while, as you say, it could contribute to the delusionary mind space of buyers but how long can that last?

heh no hat tip? You are welcome! Good blog, keep it up.

Sorry man. Post updated. You are a gentleman and a scholar!

Another gem… 🙂

To be fair, any definition of the world should include Asia. That is, after all, the home of the current “rich foreigner myth” over here in Vancouver. It’s house prices in Asia’s major capitals that these mythic foreigners would use as a comparison to Vancouver. I hear a bird chirping. What’s that you say? Cheeep. Cheep. Cheeeep.

Living here for over 15 years now, I feel that this statement in an honest and fair portrait of Vancouver:

“What Vancouver gets is an economy that boasts a lot of froth, and not much substance. From all three angles, it feels like a relationship that is built not so much on Commitment as on enjoying the good times while they last.“

Please be aware that the “wealthy Chinese investor” the greater paragraph alludes to is just the latest of several waves of immigration and investment from Asia over the past decade and a half. Now it’s wealthy Chinese and hot money, before it was Hong Kong and satellite kids, before that it was Taiwan & Korea. All this serves as a base under the most recent high end prop. These people also become “local buyers” as per Landcor data, but more on that later.

This ‘house of cards’ feeling in Vancouver is a common perception as there are still no major business to brag of like there are back east. Vancouver and BC has a long history of scams and an economy that seems like it’s built on hot air, but boy can they grow real estate prices.

The writer is quoting a statistic that other posters from Vancouver have seen. It was recently published by a realtor and was a survey of $2M+ westside homes in Vancouver from his office. I will try to look for it and link it should I get a chance. It upset a lot of bears but I have heard it from other agents before he posted it. It was his attempt to investigate and quantify rumour.

And as I’ve said before, the ‘blue rinse crowd’ … that would be the local 65-85 year olds (gran and grampa) who have lived in these neighbourhoods for the past 50 years who are now selling up to this “mythic buyer”. They ain’t sellin’ to each other that’s for sure. What? And take out higher and higher mortgages to impress their friends? They aren’t selling to their kids because each of their kids is looking to them for hefty down payments to be able to stay in this city.

It’s true. Chinese investors look for Chinese realtors. But FYI there’s no strictly “Chinese only” realty office. And you could also say that you’d only get this perspective from the people making these deals. And that would be mostly bilingual Chinese realtors. But non-Asian realtors in their offices have validated these stories to me personally and other people I know. Although they have lamented to me that not everyone has 2M+ to spend and that sales are indeed infrequent in this area. But this is all hearsay and Landcor has hard data, right?

Landcor data falls squarely on your side of the equation disproving the rich foreigner myth at a glance. But does it capture what’s really going on? Hot money in suitcases? (Could be rumour, I admit). Money from family living abroad being invested by new Canadian families here. Limits of 50K out of China being a joke for those with guanxi.

I sincerely hope the Landcor data is right and that myself and others are in the middle of a purely speculative and local bubble and are mired in delusion. Yet the data also fails to explain the extra-extraordinary pricing of recent months. No doubt the uber-rich are back and they’ve gotten frugality-fatigue when it comes to their discretionary and investment spending. Vancouver and Sydney have been a safe haven for their money and continue to be for the time being.

Question is, can these newly minted billionaires with their excesses moola and love of Vancouver real estate combined with our previous multiple waves of real-estate-crazy-investor-immigrants now awash in equity keep this monster propped up?

It’s not like Vancouver West Side SFH is a big block to buy out, compared to all the money in China that is.

Patz -> “How would that trickle down to and be a factor in the mid and lower range?”

The ‘trickle down’ is psychological… local speculators tell themselves the ‘HAM’ story (along with running-out-of-land and best-place-on-earth) and they borrow more and buy more.

—

mac ->”The writer is quoting a statistic that other posters from Vancouver have seen. It was recently published by a realtor and was a survey of $2M+ westside homes in Vancouver from his office. I will try to look for it and link it should I get a chance.”

The origin of the statistic is from MacDonald Realty November Market Update, November 2010… we have previously archived it –

“Macdonald Realty president & CEO Lynn Hsu showed a Macdonald Realty analysis of Chinese buying trends which showed that 78% of homes in Vancouver valued over $2 million were bought by this demographic. This trend is expected to continue as there is a 10-year backlog of investor category Chinese immigrants waiting to come to Canada, the vast majority of which are planning on settling in Vancouver. Sellers of these properties tend to pocket the appreciation in their homes and move to other asset classes in the city or to other municipalities in the province, which results in an upward push in prices.”

[Note: From the wording, it’s not clear if “this demographic” includes local members of the Asian community or investor category immigrants.]

What you missed in your analysis of the Landcor data is the “high end” part. I just did a quick search on mls.ca and found that there are 3052 homes listed in Vancouver, of which 411 were priced over $2,000,000. So the high end is made up of only 13% of the units in the market. If you then take Mac Realty’s 78% of that 13%, you’re left with a little over 10% which is pretty close to your calculation. If you take the 2,500 new investor class immigrants each year, plus any foreign investors, plus any Canadian citizen Chinese included in Mac’s “this demographic” I think you could easily reach the 78% from Mac or 80% mentioned in the article.

And from Ireland today, the Irish Prime Minister had this to say about the budget….

When asked last night about the reasons for the massive adjustment, Mr Cowen referred to the collapse in the construction industry. “People were expecting a soft landing and it didn’t happen. The analysis was wrong and the advice was wrong. I take responsibility for that and I have never ducked that.”

Emphasis mine.

Yes, you see, ALL of the analysis and ALL of the advise was wrong. Nobody saw it coming. They will say the same thing when TSHTF here.

Watch out for that big red herring!!

The argument about HAM and rich Asians can be misleading. The very wealthy will always be among us (actually locked away behind gates, but you know what I mean).

Florida is ground zero for the US housing collapse. I started seeing the for sale signs going up on Marcos Island years ago. It was worse than the bill board blight on I-95.

However, there are very few for sale signs in south Naples, just a few miles away, where all the $50M houses are. Sure, you will hear about some starlette or over the hill actor losing their castle, but that has always happened.

The wealthy don’t make the market. They can drive prices up in exclusive neighborhoods, for sure, but they don’t make the market, they only distort it. The housing decline/collapse/rout will come from simple debt fatigue of ordinary people who live in ordinary houses in any one of thousands of ordinary neighborhoods.

It is not “real wealth” that has blown the bubble. It is debt.

It’s the Government with its low interest rate, not the foreign money.

Once it goes higher, you will see.

“It is not “real wealth” that has blown the bubble. It is debt.”

On point.

+ 4%

Pingback: Frenzied Spike In Canadian Media Articles About Asian Immigration | Vancouver Real Estate Anecdote Archive

Thanks for the good analysis on this article. I read this article and thought that it wasn’t entirely accurate. So what if rich people are coming here from China to buy houses? They certainly aren’t buying that Vancouver special on the east side. There’s a mismatch here, that while supposedly rich foreigners are driving up real estate prices, it’s reported nearly every week that Canadians are drowning in debt. It won’t be the rich foreigners who crash the market, it will be those on the margins-the ones with the high mortgages, who won’t be able to keep up when interest rates go up, or they lose their jobs.The market is certainly not sustainable, even with the rich foreigners.

“The housing decline/collapse/rout will come from simple debt fatigue of ordinary people who live in ordinary houses in any one of thousands of ordinary neighborhoods. It is not “real wealth” that has blown the bubble. It is debt.”

That’s both my hope and fear articulated in one thought. Decline and collapse for the ordinary Canadian with ongoing growth and wealth for the top tiers. A bifurcated housing market and a social order more like Britain and the USA than anything us ordinary Canadians have seen before.

While being fairly bearish on the BC real estate market, here’s my take.

Prices are set at the margin. Yes maybe immigrants are only 7% of the market, but that 7% has the ability to outbid the locals and drive up prices. Also if we are talking <2500 house purchases by wealthy people, it's most likely in the nicer areas of Vancouver, not teardowns in Burnaby. With those thoughts, I can see wealthy chinese immigrants making up a large proportion of some local markets, driving prices way out of line with local affordability.

As the realtors love to say "real estate is local"

People making traditionally good money in Vancouver (lawyers/Surgeons/etc), start to find the areas where traditionally people of their social status would live too expensive. They then begin to start moving further out into tradionally less desirable areas, i.e. East Vancouver instead of West, North instead of West Van. Pushing the blue collar people from those neighbourhoods further out.

OR They try and stay in those traditional areas, take on huge mortgages thanks to low interest rates and add suites. Eternally hoping that the chinese party continues and the value of their house outweighs their mortgage.

Two main problem points I see are interest rates and the Chinese economy.

If interest rates rise the locals won't be able to continue paying these high prices, but the immigrant cash buyer doesn't care. Areas supported by credit, (most of Vancouver) will take a bath, those supported by cash will take a hit, but a lot less so.

Who knows what the future holds for China, but some sort of economic shock would probably destroy the local resource based economy and slow the influx of immigrant investors, making this terrible for everyone, including renters.

Feel free to poke holes in my analysis, I welcome the feedback.

This is very very correct. Locals living, prices set by outsiders. Nobody works in Vancouver, people just live in there

The analysis in this article is terrible. If you disagree with someone, why bother with the grade 9 level analysis? Just yell and scream and make inflammatory comments and use lots of explanations points throughout. If your audience is unable to see the flaws in your post, why bother with all the numbers and critiques of the article in question? They’ll read and agree with anything that you say ‘cuz they’re already onside. You’re making it hard on yourself. If you want to influence people who don’t already share your views; do a better job analyzing the topic. Otherwise you’ll just turn them away, which you have with this post. Net impact: zero.

“The analysis in this article is terrible…..If your audience is unable to see the flaws in your post, why bother with all the numbers and critiques of the article in question?”

That’s it? No sharp rebuttal to my points? No counter facts? Sad, dude. Come back when you’re ready to enlighten us with an actual rebuttal.

Again, why don’t we start with reality Ben, yours that is. Income vs Housing average – you say no way right? So then explain to me why a japanese girl sleeping in a line at new condo opening to get her hands on a 700K studio so she can learn to snowboard once a year makes sense?

It is happening? So try to explain the reality why it’s happening, lets understand the large downpayment that can change this ratio, money from outside. Vancouver is NOT a part of Canada. It is a suburb of Asia, these prices are not out of line in that context.

Visit Fort McMurray when oil was 150$? I did, the home prices up 100000%, but also wealth landed in that region.

Don’t get me wrong, I am a fan of your work and thoughtful analysis, but don’t be scared to be a capitalist and look it things as the current market reality is. Start at that point and try to explain it, then attack it as you so well do.

The analysis is not terrible, just the starting point is off. Using the moons location to try to find a local restaurant. Ben is throwing something at the problem that is thoughfull Just needs some other points as well.

Pingback: UK house prices falling; Carney’s debt conundrum; Is the smart money fleeing China? | Financial Insights

Pingback: Frustration in Europe’s youth; Public unions under the gun in the States; China considering major property tax to squeeze bubble | Financial Insights

How do they determine foreign ownership? I read the report and didn’t see it.

If they’re using tax-bill addresses, this might dramatically understate the number of foreign-owned properties if family members live there, and so have the bills sent there.

Pingback: A call for data: Just how much of a role does Hot Asian Money play in the Vancouver real estate market? | Financial Insights