In part 1 of this series we looked at construction employment as a percentage of total employment, and residential construction as a percent of GDP for all provinces from BC east to Ontario.

If you haven’t read that post, make sure you do as it also explains how falling house prices tend to dampen demand for housing, a strange and seemingly counter-intuitive phenomenon. The reality is that both of the metrics we’ve examined are well above their long-term trend lines in all provinces examined in part 1. The implication is that if there is a significant correction in house prices, history tells us that housing starts fall and construction employment comes under pressure. In the absence of significant government stimulus measures like infrastructure projects, GDP and employment face some headwinds on this basis alone.

By these measures, the economies of provinces from Ontario west are at risk of facing economic headwinds in the increasingly likely event of a housing correction. What is not measurable however, is the level to which consumers might retrench and slow their spending amid a housing correction. The housing wealth effect is a well-studied phenomenon. The rapid expansion in home equity withdrawals via HELOCs (the fastest growing form of consumer debt) would certainly come under pressure. The economic impact of a significant housing correction would be much broader and more significant that the two measures we’re examining in this series.

With all that said, let’s have a look at all provinces from Quebec east to Newfoundland.

Quebec

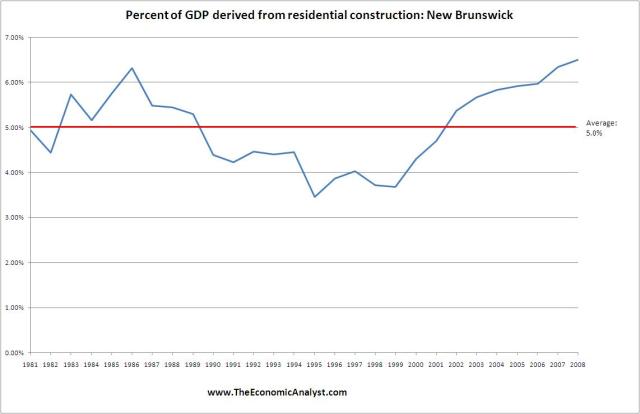

New Brunswick

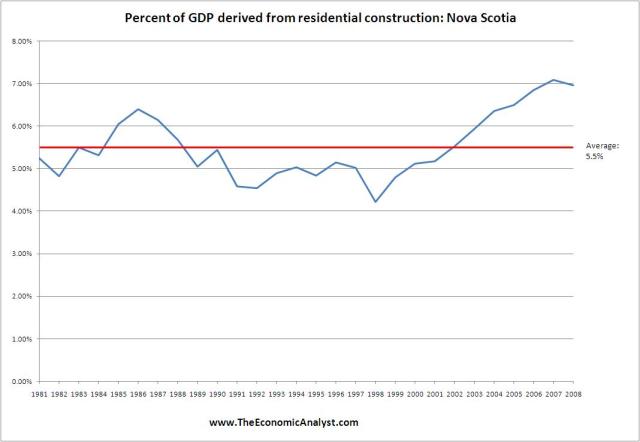

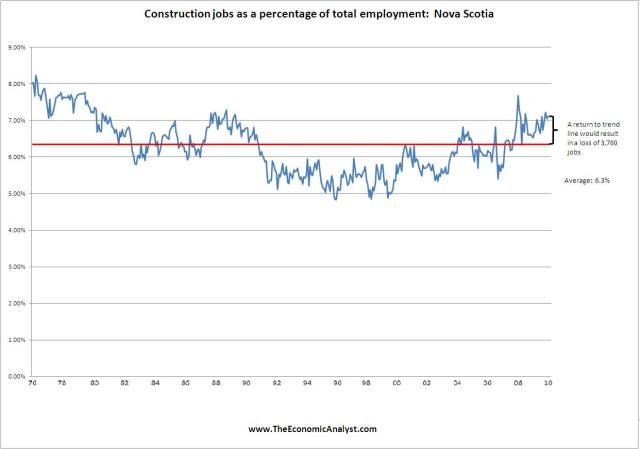

Nova Scotia

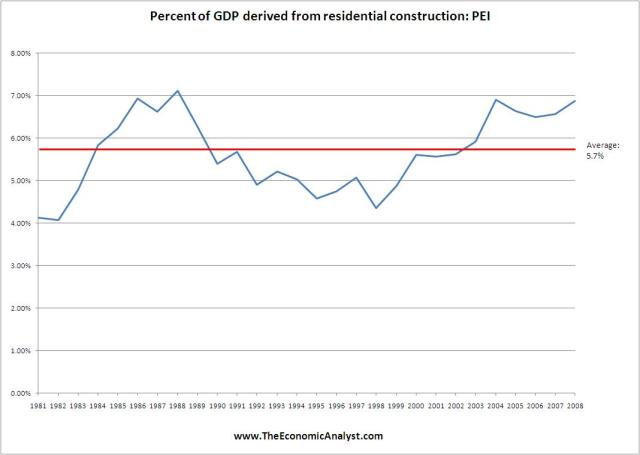

Prince Edward Island

Newfoundland

As was the case when we compared the growth in provincial per capita GDP and house prices (part 1 and part 2), it appears that the further east one travels, the less risk is posed by widespread housing correction. Certainly Quebec seems quite vulnerable as does New Brunswick and Nova Scotia, but it bears remembering how far their house prices have strayed from underlying fundamentals in discussing any economic risks posed by a realignment in house prices. In the case of Nova Scotia and New Brunswick, only a mild overvaluation existed suggesting that the risk of a significant house price correction is more muted in these provinces than some of their bubblier neighbours. I wasn’t able to obtain Quebec resale data and was unable to show how far (if at all) their house prices had strayed from the underlying growth in their economy. I since have obtained the data, but I’m trying to understand how to use it for long-term comparisons as they changed the way they report their numbers in 2002, making comparisons between periods difficult. I’ll see what I can do there.

Cheers for now

Ben

Hi Ben,

A couple of questions. Looking at the Quebec data, by construction jobs, do you mean real estate related construction jobs or does this include stuff like road and bridge construction?

If 38,000 represents 1.12% of construction jobs, then there are roughly 200,000 construction jobs. 38,000 is roughly 19% of construction jobs.

Are you saying that, should real estate construction related activity revert to the historical trend, 19% of Quebec construction jobs would be lost?

It would look from your chart that, since 2000, the real estate related construction trades in Quebec have grown by more than 40%. That doesn’t sit quite right as there hasn’t been a commensurate rate of growth in new construction.

What numbers do we have available on the rate of growth in new construction over the past ten years?

Hi John

This is all construction jobs. The data is from CANSIM table 282-0088

Quebec is reported to have 230,000 construction jobs, so yes, a 1+ percent drop in construction employment would wipe out 18% of of the construction workforce.

I had a look at housing starts data for Quebec. Housing starts per 10,000 rose from 35 to 65 between 2001 and 2010, with a peak in 2004 at almost 75. From this perspective it certainly looks like there has been a rise in new construction relative to population.

I found some numbers from CMHC covering total residential construction for Quebec going back to 2004 and the CHBA back to 1997.

1997 — 26,000

1998 — 23,000

1999 — 26,000

2000 — 25,000

2001 — 28,000

2002 — 43,000

2003 — 50,000

2004 — 58,448

2005 — 50,910

2006 — 47,877

2007 — 48,553

2008 — 47,901

2009 — 43,403

2010 — 43,850 (F)

2011 — 41,650 (F)

I don’t have the numbers, but commercial real estate won’t have been significantly different. The trend in your account of “construction jobs as a % of total employment” in Quebec has been positive since 2004. The trend in construction has been clearly negative since then.

This makes me wonder whether there has been an increase in construction jobs or a decrease in jobs of other types since 2004. At any rate, it looks like the boom years were between 2000 and 2004. The Royal Bank points out that affordability remained constant during that period due to lower interest rates.

I just want to point out that a reversion to the mean can occur by other sectors of the economy increasing employment, meaning there does not need to be a loss of jobs in construction.

“I just want to point out that a reversion to the mean can occur by other sectors of the economy increasing employment, meaning there does not need to be a loss of jobs in construction.”

Very good point!

“This makes me wonder whether there has been an increase in construction jobs or a decrease in jobs of other types since 2004.”

In January 2004, there were 3,639,200 employed persons in Quebec. In May 2010 (the last data point) it was 3,909,300 for a growth in total employment of 7.4%.

In January of 2004, there were 166,800 people working in construction in Quebec. In May 2010, that number was 228,900 for a growth of 37.2%.

Total employment is still expanding, but the growth in construction jobs has outpaced growth in other forms of employment.

Just to clarify, do we know whether construction jobs, in this data set, is real estate oriented, or all construction jobs?

Other sectors can pick up the slack but don’t seem to be doing so, yet. Construction and gov’t jobs (the latter which have also increased of late) are really just a placeholder until the real economy starts investing again. I do not see infrastructure spending as offering a stellar return but it beats having people doing nothing.

It’s worth asking what sectors will start spending again and when. It’s getting late…