These are great questions. I receive a couple emails each week from people looking for advice on this topic. Some are potential first time buyers, but many are existing home owners. My advice to those people may surprise my readers as I have yet to explicitly suggest that it is in someone’s best interest to sell their current home.

Should existing home owners consider selling?

It’s not an easy decision, and it is far from clear-cut. Even if we forecast a 20% drop in house prices in a certain location, does it automatically mean that all home owners would be wise to sell?

It’s a matter of weighing out the cold-hard math versus the intangible benefits of home ownership. It’s seldom a clear-cut decision. In any of my discussions with people on this topic, I always ask them to consider the following if they are a home owner contemplating selling:

- What is the outstanding mortgage versus their income? In general, a ‘safe’ mortgage value is no more than 3 times household income and preferably closer to 2 times income.

- How safe are their jobs? It’s easy to overestimate our job safety, so keep this in mind.

- Are they relying on the equity in their home to help fund their retirement? If so, it is much riskier to be holding a home as a retirement investment when valuations are at such precarious levels nationally. This is a major point. In previous posts I’ve explored the potential impact of demographics on house prices while trying to highlight the amount of near retirees who are planning on accessing home equity to fund their retirement. It is significant. If you are near retirement and are banking on that equity, your are taking a major gamble. In this case I would suggest that it far more beneficial to sell a year or two too early than a month too late.

- Do they have children? Would they have to uproot their children and possibly change schools? The disruptive nature of a move should be considered by any rational parent. It should not necessarily be the primary determinant, as overall financial stability is of far more importance, but I would caution against a serious disruption for children for the sake of saving a some home equity. This is particularly true of people who have substantial home equity, are living in a less bubbly area (as determined by price/rent multiples which we’ll look at), and who could withstand a 20% correction without being in a negative equity position. Things change when we’re dealing with more significant over valuations.

- How would a doubling or tripling of interest rates impact the ability to service debt?

- What would the house rent for? What would it likely sell for at current market prices? You can make a good approximation by looking at houses for rent on kijiji, mls, or by talking to a realtor. We have a tendency to overestimate both the value of our home and the rent it would fetch by approximately 10%. Adjust accordingly. The price to rent ratio of homes in a city are perhaps the biggest indicator of whether or not it is prudent to buy or rent. We’ll talk about that in a moment.

As you can see, it is not an easy decision to sell one’s current residence and consider renting in this current market. In many parts of Canada where the overvaluation may be slight to moderate, a good portion of the potential savings from selling a residence and trying to time re-entry into the market are eaten up by transaction fees and moving expenses.

In some of the bubblier areas (Vancouver and increasingly other areas of BC….and the Toronto condo market), selling and renting may make sense. In some cases, if you can tailor a deal with a real estate investor to rent back your current residence under a secure, long-term lease, you can possibly get the best of both worlds. This is particularly true of condos where up to 40% of condo purchases are by ‘investors’ (speculators would be a better term as most condos in the country’s largest centres are cash flow negative meaning the investor has to pony up money every month to make up the difference between carrying costs and their rental income. Some investment!).

Should potential new buyers sit on the sidelines in all markets?

When it comes to first time buyers, the decision is often much easier. However, it doesn’t automatically stand that all first time buyers should sit on the sidelines in the current market, though overwhelmingly it makes sense in most locations. Again there are many considerations that go into this decision:

- Job safety. Along with this I would also add that buyers should make sure that they are committed to an area for at least the next 5-10 years. If you know you’ll be moving to pursue other opportunities in a few years, it makes far more sense to rent rather than roll the dice in this market and have to pay transaction costs when you sell.

- Down payment. I would strongly suggest that potential home buyers save up the 20% down payment needed to avoid CMHC insurance fees. Those fees aren’t cheap (2-3% of loan value in general). While you can buy today with zero down if you take advantage of some of the cash-back offers from the banks, the reality is that your ability to manage your finances to a point that you can accumulate a down payment is an indicator of your overall financial health and responsibility. If you can’t save a substantial down payment, you’re not financially ready for home ownership. Period. I often hear people protest that it would take them years to save up a healthy down payment in the current market. Two thoughts on this:

- 1) Welcome to the reality that existed in Canada up until the late 90’s when down payments were lowered. We live in an instant gratification culture that is largely anomalous in the context of our own history. The reality is that these periods of significant change in consumer psychology tend not to represent a new and stable norm. One need only look at the rapid rise in debt relative to incomes to see that this is a trend that will not be sustained. Rather they tend to revert back to their long term (and more sensible) norms.

- 2) I am not entirely unsympathetic to this statement as it can also reveal the extent of overvaluation in some markets. In markets where it would take a typical wage earning household many years (or decades) to save up a healthy down payment, it should serve to highlight just how unsustainable the current market dynamics really are.

- Interest rates and total debt levels. Many potential new home buyers have no idea how truly remarkable current interest rates are relative to the long term average. Double digit interest rates of two decades ago seem like distant relics that could not possibly reappear. Beware of this mentality. While I do think that interest rates will likely stay unusually low for some time, the overall direction of rates is undeniable. Calculate affordability based on an interest rate of at least double our current one.

- Consider lost opportunity costs of the down payment, taxes, insurance, miscellaneous maintenance, and transaction expenses when calculating whether or not it is better to rent or buy. Many people look only at the mortgage payment and equivalent rent. This is a mistake. For a more detailed breakdown of what should be considered in this calculation, have a look at this post.

Making the buy or rent decision considering the price/rent ratio

The house price to rent ratio is arguably the best tool for determining whether it makes sense for a potential first time buyer to take the plunge and whether it might make sense for an existing home owner to sell.

The ratio is usually expressed as the price of a house divided by the annual rent it would receive OR as the price of a house divided by its monthly rent.

For example, a house that would likely sell for 300,000 (look at MLS for comparables) and could be rented for $1500 a month (look at kijiji or talk to a realtor for rental data) would have a price/rent of 16.7 when annual rent is considered, or 200 when monthly rent is considered.

As a very general rule, the price/rent multiple on annualized rent has a long-term average of about 15.

To determine the price/rent ratio for your city, either do some snooping around on kijiji and MLS to figure out asking prices and rental rates. CMHC also calculates rental data for various cities, though most of their data is centred around the condo rental market.

It is worth noting that even in cities that are close to reasonably valued, great deals can still be found. I wrote about this in a previous post titled, “Vulching a rental home“. Despite the fact that the housing market is not atrociously overvalued in my area, I was still able to find a fantastic rental house with a price/rent ratio of nearly 30!!!!

A closer look at the house price-to-rent ratio

It’s first worth noting that the aggregate price/rent ratio in Canada is at an all-time high.

In fact, back in 2008, the OECD released house price and rental data for a number of countries. When compiled, it gave us the following graph. Note that Canada is the light blue line and at that time was second only to Spain in terms of our house prices versus the rent they would fetch.

None of this is particularly new. In fact, in a 2005 paper by the OECD, they recognized that massive, anomalous rise in price/rent ratio across Canada. With the exception of a brief dip in 2008-2009, we know that in the time since 2005, prices have far exceeded rental growth.

However, this is aggregate data that does not capture the variability between cities and even between market segments within the same city. Nevertheless, it suggests that the typical first time buyer in Canadian would be reasonably advised to rent. At the very least it suggests that some research within a market to ascertain the local price/rent ratio is certainly in order.

Accounting for the change in price/rent ratio over time

As with so many measures of fundamental value that are currently well outside their normal range, the change in the price/rent ratio is often glassed over or explained away with a ‘new paradigm’ mentality. That’s bunk!

In an interesting 2004 paper by the Federal Reserve Bank of San Francisco, they discussed the change in the price/rent ratio in the US. In particular they examined the factors that cause the change and what it means when it departs significantly from its long-term mean. This was the conclusion:

…Most of the variance in the price-rent ratio is due to changes in future returns and not to changes in rents. This is relevant because it suggests the likely future path of the ratio. If the ratio is to return to its average level, it will probably do so through slower house price appreciation.

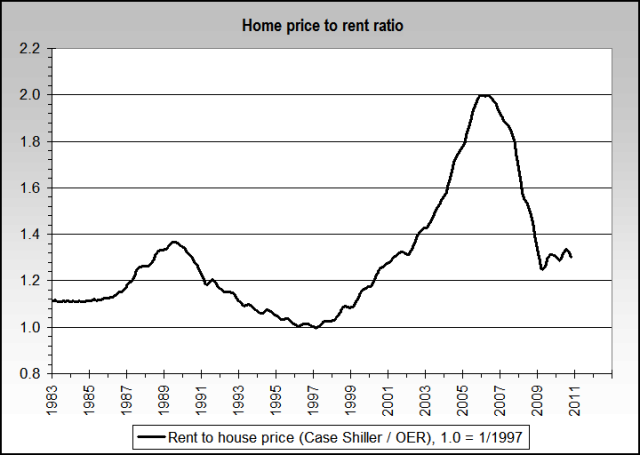

How remarkably prescient that statement turned out to be. As we know, asset prices that deviate markedly from their long-term measures of fundamental value seldom (if ever) correct by going sideways. The animal spirits of shifting mass psychology virtually ensure that an asset is either widely loved or nearly universally despised. In the case of the US, here is their experience with their price/rent ratio:

Final considerations

Ultimately first time home buyers are faced with a decision of what to rent. They can either rent space or they can rent money. But overwhelmingly, they are still renters. The question then becomes which form of renting makes most financial sense.

By way of probabilities, it is overwhelmingly likely that the decision to rent a home in the current market will prove to be more financially beneficial for most first time buyers provided that they are disciplined enough to save the difference between the cost of renting and the cost of ownership. It is equally important that they then build investment portfolios that match their financial goals. For more on that, please see the three-part series on building an investment portfolio.

The house price to rent ratio provides one of the strongest signal of overvaluation in the Canadian housing market. While skewed higher by a handful of very bubbly cities and market segments, it nevertheless remains elevated in most parts of the country. This is far more likely a reflection of changing attitudes towards renting than it is a new and stable paradigm. As such, it bears careful consideration when taking the initial plunge.

For existing home owners concerned about the possibility of vanishing equity, the decision to sell is complicated by significant transaction costs, equity levels, and the extent to which each owner is reliant on home equity for retirement. Furthermore, there are substantial intangible benefits associated with ownership, particularly when school aged children are involved. Decisions must be made by each family, and to this extent my ability to provide guidance on this topic is highly limited. Nevertheless, I’m happy to give my opinion for what it’s worth.

Cheers,

Ben

Great post, Ben.

Excellent. If I encounter anyone facing this decision, I’ll refer them here.

Nice work. very informative.

once you have reached your family peak, you will seek out a good area with schools. Your kids will be in that system for at least a decade or so. Buy. If your job moves you, the company usually keeps a person whole.

This is interesting, since 1997 Canada has given real estate investors about 4% annual returns over the last 14 years. Nothing brag about, but who knows what it cost to keep that real estate every year, etc….interesting point is Hong Kong (the Vancouver buyer) is now at the same level where real estate in HK was in 1997. Yet on a y-o-y sort, they look “bubble-ee” So based on your rent vs buy, all the duration life points are the ones that need to be asked. y-o-y is not a good starting point. If you are planning to live to spend your RRSP cash (actually you have to hand it to financial company to rip your face off into a annuity) and your family and job are on cruise, buying makes the most sense…

“This is interesting, since 1997 Canada has given real estate investors about 4% annual returns over the last 14 years.”

It’s a list of home price changes. Does it really make sense to talk about “annual returns” on an illiquid investment? I can’t see how there’s a “return” here unless you exit the market.

you ever heard of HELOC? – you don’t need to exit the asset to get your money out. The asset is marked by your bank and you can borrow against it’s worth. If you started with a place 1997 for 100k, today worth 500k, the bank looks at the 500k, not 100k.

HELOC’s are liquid.

Thank you for the excellent post!

Love the blog.

Cheers.

Ben, I think you have to look at p to rent as follows

Canada is no where near spain as you would suggest on long run average dev. In fact p/r on average graph would suggest Canada is currently one of the LOWEST places for that matter. Using just 2008 numbers is not a great benchmark to make your claims.

This is not dealing with price/rent ratios at all. In fact, the Economist uses the New House Price Index which is quality adjusted and has shown very little growth over the past decade.

The quality adjustment factors out things like the expansion in average house sizes. If the average new house one year is 1000sq.ft and costs 150K and the next year the average new house is 2000sq.ft and costs 300K the NHPI actually shows no increase in house prices. It’s misleading. What the Economist data fails to account for is the possibility of a change in consumer expectations:

And for a great example of how the NHPI can mask a bubble, check out this report by the New York Fed from 2004 in which they argue that there is no bubble in the US because….get ready for it….the NHPI had not shown the same increase is existing house prices (exactly the situation in Canada)

Click to access 0412mcca.pdf

For a real laugh, consider that according to the NHPI, it costs less in nominal terms to buy a new house in Vancouver today than it did 10 years ago. Some index!

“y way of probabilities, it is overwhelmingly likely that the decision to rent a home in the current market will prove to be more financially beneficial for most first time buyers provided that they are disciplined enough to save the difference between the cost of renting and the cost of ownership. It is equally important that they then build investment portfolios that match their financial goals. ”

What if prices continue to go up/down? You are hedging yourself very well here

Savings – prices go down

Investments – prices go up

Better to deeper dive on Balance Sheet to get this right

Home + Diversified Savings

Rent + Diversified Savings

Each individual needs to stress test those and guess to correlation of events to get a true answer. What if a financial GOAL is own a home one day?

Why don’t you use a real example, say a couple with 100k combined income? What would you suggest to them? Two kids.

I am a guy who bought in 1999 and the feeling to pay a very reasonable price for your house is fantastic. Now i have to buy with my girl friend and its not the same situation, its very very no-comfortable! Stressful and and i dont know what to do. The GAME IS RIG. The rulers decide, when to pull the plug. Are when to inflate. Some will be LUCKY some will NOT! Thats it!

A question on the price/rent ratio you mention above… Is that rent number “all inclusive”, or is it just the price of the rent alone that you use? For instance, we’re renting a house that would probably sell for $300,000. Our rent is $1,600 per month, but that’s with utilities included. So if we use the $1,600 as the rent, in that case the P/R ratio is 15.625. However, if we deduct the utilities, the rent number would likely be around $1,250. In that case, the P/R ratio is 20. Which one is it?

Price to rent is primarily a gauge of investor returns. If earnings are low compared to price, investors are either expecting future appreciation, like a “growth” stock, or are willing to accept lower returns.

Investors will look at net income but since expenses are usually well defined for RE we just look at revenue to keep it simple.

Why are investors important? Because they eventually act as the marginal buyer: they comprise 30% of the stock and arguably that share will increase like what happened in the UK/US.

Jesse I was hoping you’d chime in on this post. I’m happy to refer to your input on some of these comments since I know you’ve done quite a bit of work using the P/R ratio. In particular, does the long-term average of 15 (implying 6% gross return) sound right? From the limited data sources, this seemed to be the consensus, but it actually struck me as being too high. Any take on that?

@fi, I think it depends on the property. For condos attracting high quality tenants, I would argue a rational investor will demand more than this. A cap rate (NOI/Price) of 8% sounds about right, for a price to monthly rent of 125.

As a gauge of what “should” be expected, look at what REITs are demanding for their residential holdings. Small-time DIY residential investors often won’t include management fees in calculations, and often won’t account for aggregated risks that larger and diversified companies see off the bottom line.

For detached properties, a higher P/R can be expected if the area is expected to increase in density: future cash flows will outpace rents from existing structures. Further, certain areas where long-term average income gains have been substantial (I’m thinking areas of Toronto like Mt. Pleasant) can be expected to have lower P/Rs because it is expected rental and income growth will outpace inflation. The question is how much of a premium should there be for these things? I don’t think it’s a lot, probably 1-2% lower cap rates at most.

A big open question is how much do financing rates affect cap rates? From a high level we can expect that lower interest rates means lower income growth. From a DCF point of view we have annual income X, inflation i, and discount rate r: NPV = X(1+i)/(1+r) + X(1+i)^2/(1+r)^2 + … + X(1+i)^n/(1+r)^n. With simple math this reduces to NPV = X/(r-i). Since the discount rate includes inflation expectations, we are left with NPV including only the spread over inflation. That’s the theory anyways. So the question is can lower interest rates lead to permanently higher prices?

“So the question is can lower interest rates lead to permanently higher prices?”

Yes, in the short run you get a very large increase and prices “reset” to a higher level- basically pushing affordability out of society’s balance sheet, however once the balance sheet get’s to a point of “breaking”, low rate impact stops and only strong balance sheets are buying at the now marginally higher reset price level. This is what many bears are focused on today, rich people levering. When the banks start to let the poor in on this trade or weak balance sheets, that is when things “break” and you get US type crash.

sorry, Jesse one last point. In my view, the Canada housing market is still in very early stages of the prime to subprime spectrum. I believe prices will continue to grind higher on a national average and still see vapour pockets of up violent gaps in some areas. We are more in the middle at best. When you are cab driver is long 5 spec homes, that is probably when you should be worried. Don’t see that yet. What i do is people needing a wake up call and need to stop believing in fragmentation of balance sheet. I own a house, mortgage and have “savings” in RRSP. They don’t have savings and believe that GIC is untouchable by anyone. If the balance sheet blew up, that bank can take it. They feel the net worth is stronger.

100k Mortgage = 100 units of pain

100k GIC = 150 units of pleasure

So mentally people pleasure looking at home price value + mtg + gic…this is very wrong. I see this hubris as probably the very small factors that will carry people out of housing.

I pay $900 rent for a house that’s for sale at $240k, this is a good deal. On top of it, it’s $4000 taxes per year I’m saving (plus maintenance and cashdown and fees).

It is difficult to find a rental house, many people either ask too much because they can’t sell and want the rent to cover everything, or they think that their house will sell quickly at their asking price so thy don’t put it up for rent. I was lucky to rent a house that has been for sale for a very long time and the owner can’t reduce price because of mortgage on it.. if she sells, not sure if I’ll be able to find a deal that good.

It was also very hard to convince my girlfriend that renting was the better option, she wnated a house, liked the house shopping, all her friends#sisters own. Now with all the numbers I’ve crunched for her, she understands and is ok with the decision. Still, renting has a bunch of inconvenience as you know you won’t be there for a long time.

i think your lady friends are more farsighted than you think 😉

@ Sam

Thanks for the vid.

Re: your comment directed at Jesse

With no disrespect intended, I’m not sure what you’re trying to say in your two comments to Jesse. You completely lost me.

In summary

1. Affordability came to people, not the other way around, so low rates can reset home prices higher from lower rates to a point. On the margin strong balance can only take prices higher or super lax lending to poor.

2. The typical house balance sheet is

BS A

+House =100k

-Debt = -100k

+GIC = +100k

= +100k

BS B

+House = 100k

I believe from dealing with newbie real estate investors/owners, they feel the GIC is more real then the debt. In other words, they seek to get the highest interest rate while not paying down debt. They fragment them. They don’t see it as the same. So people feel richer in balance sheet a than balance sheet b. This type of account gets people into trouble.

Now i bet people have

BS C

+House

– Mtg Debt

+ GIC

– HELOC

This is even worse. Messy balance sheets for people that don’t know how to manage them can get very sloppy. When the only + side is the House and Income is supporting the balance of the line items.

I hope that makes it clear.

“So people feel richer in balance sheet a than balance sheet b”

While people may think of debt different from savings, you can’t “feel” your way to making an investment better than it is.

It’s important to remember what debt really is: in normal times if you partner with someone for an investment — borrowing money from them by any other term — they will want a cut of the investment returns. If you use your own money you keep their margins.

In terms of mortgages, a lender is simply investing in a borrower: when you apply for a mortgage you are effectively writing business case why they should invest their money with you. In the case of mortgages, the bank is in almost at a “can’t lose” position in terms of loss recovery but practically they care a little, as servicing a bad loan generally is a pain in the rear end logistically.

I agree people are generally not investment bank caliber when it comes to their finances but IMO that’s all the more reason why poor price-rent ratios are unsustainable in the long run.

Pingback: Reckoning day for the mortgage market?; More on the price/rent ratio | Financial Insights