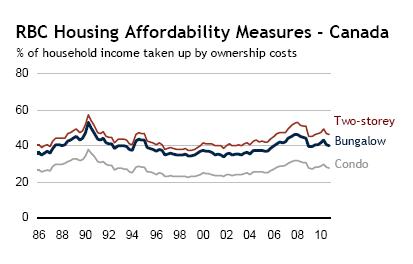

RBC has released their latest housing affordability report for Q4 2010.

Key findings:

Housing affordability improved modestly in Q4 2011 on the back of lowering fixed (qualifying) interest rates.

“Housing Affordability Measures fell in the majority of provinces in the latest quarter (meaning housing became more affordable -ed.). Only the standard two-storey benchmark became less affordable in Ontario and Quebec, as did the standard condominium apartment in Quebec and the Atlantic region. The most significant improvement occurred in Alberta, where falling home prices once more contributed to lowering the bar for homeownership.”

The carrying costs of the standard detatched home in BC continues to consume between 60% and 70% of average family income, while in Toronto it consumes between 40% and 50%. The affordability winner remained Thunder Bay where carrying costs ran at 10% of income.

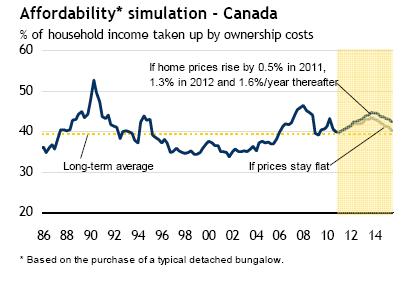

Affordability projections:

The improvement in affordability in the last two quarters is likely to be short lived. Earlier this month, Canadian financial institutions raised posted mortgage rates for the first time since November 2010—by 0.25% to 5.44% in the case of the five-year fixed term.

Given our expectation that the Bank of Canada will resume its rate hike campaign this spring (adding 100 basis points to the overnight rate this year and a further 150 basis points in 2012), borrowing costs are set to climb further still in Canada in the next two years. We believe that this will be the dominant factor that will cause housing affordability generally to erode across the country going forward, yet the magnitude of this deterioration is unlikely to derail the housing market.

Housing affordability continues to appear reasonably healthy until one considers current interest rates and the inevitable upward direction of rates over time. When compared to rents, it still makes sense to rent space rather than money in most large centres, though that certainly is not the case across the entire country.

Cheers

Ben

Always an interesting read, Ben.

Regarding your statement “… compared to rents, it still makes sense to rent space rather than money in most large centres, though that certainly is not the case across the entire country”. Where would you draw the line of rent vs. own, i.e. when is the difference between renting and owning “small enough” to substantiate a purchase?

I am a renter myself, and quite enjoying it, though I sometimes do wonder wether the monthly savings “make sense”. There are other reasons why I currently prefer renting over owning, but I’m curious nonetheless on the ideas that others might have.

As a follow up to an earlier article we looked at on the Irish bubble, here is another interesting article which is also much, much shorter. Worth a look.

How the Irish Bubble Burst by Theodore Dalrymple.

A short extract worth noting:

Pretty remarkable for a country with a population smaller than that of Toronto.

My neighborhood just surpassed Vancouver for, quite possibly, the most expensive and least affordable real estate in the world!!

This 1008 square foot bungalow with a half finished basement just listed for $475,000.

This ain’t no McMansion!

In unrelated news, the Fed’s Bullard, always a colorful character, says the Fed may have to take some responsibility for world events.

Bullard says Fed may want to look global in setting policy

Inadvertently….just the word I would have chosen.

The best way I heard it put is that the US will get its own affairs in order, other countries like China can do the same at their prerogative. They have made their choice and inflation is the result.

I certainly see the argument and it is difficult to disagree with. The only part that troubles me is the US military bases in something approximating 140 countries around the world (including Canada). Depending on your views about Taiwan, the US even has a base in China. Doesn’t that presence suggest some sort of “big brother” protector status? If so, suddenly saying it is “every man for himself” shines a different light on the motive for those bases.

“suddenly saying it is ‘every man for himself'”

Currency is merely the means of supporting capital flows and I don’t think it’s overly difficult for each country to manage its currency without a de facto peg. The USD’s influence is self-inflicted: no free lunch and the peg policy may actually be causing more harm since inflation is a difficult nut to break (as China is finding out).

From my (limited) supply chain management experience, we shied away from vendors who had too much of their business with one customer because if the large customer suddenly pulled the plug or went under, the supplier was in deep doo doo. (That’s what happened with Rubbermaid and Wal Mart.) In many ways certain countries are guilty of deciding not to diversify their economic ties in chase of immediate profits and inflation is the natural result. A macrocosm of simple small business management. On this front I don’t think Canada is immune from lack of diversification but has a floating currency.

Jesse, do you know what the term “reserve” currency means? I mean specifically? It’s important to the dialog.

I understand the concept though I never took a course on it. There is one thing to have a reserve currency, another is how other countries decide to use the “reserve status” in their own monetary policy. There are consequences assuming a currency is more stable than it really is. The US is simply “playing its game” and it’s becomming difficult for other economies to follow.

An interesting question is whether or not the US would be more magnanimous in looking beyond its borders if it knew its reserve currency status was more free-floating.

We can quickly define “reserve currency” as “A foreign currency held by central banks and other major financial institutions as a means to pay off international debt obligations, or to influence their domestic exchange rate.”

Or something like that…

Yes, but it misses the nuance. Many central banks of small countries, Central and South America, SE Asia, Africa, Caribbean, etc., are required by the IMF and the BIS to keep a significant “reserve” of US dollars. So this is the currency that they must keep in their reserve.

Having a significant amount of US dollars poses significant exchange rate risks, so some countries elect to peg their currency to the dollar. The risk is exacerbated when US dollars become the preferred currency of choice for daily consumer transactions, even if those transactions are black market.

Certainly China isn’t a weak country and isn’t forced to peg to the dollar for its very survival, but many countries are forced to peg or face extreme exchange rate instability. The trade off they suffer is they have very little control over inflation.

Hm I guess the IMF bailout comes with strings. On a related note I think the IMF is looking to move away from solely using USD.

It’s important to look at trade weighted reserve holdings. China is the elephant in the room but there are others that in total make up around 60% of the US’s trade balance and most are not following the IMF playbook (any more, or yet).

Oops I meant 40% of trade comes from countries with an explicit or de facto USD peg.

You can’t just look at trade with the US. They must hold US dollars in reserve or they will be unable to settle their accounts with any nation.

Here is another way to think about it. The value of a fiat currency is normally set by the “good faith and credit” of the sovereign. Their bonds are enough for the central bank to hold to issue currency. Canada falls into this category.

Some countries don’t have a good credit rating, so their US dollar reserve holdings are a bit like those credit repair credit cards. Pay in advance and we know your credit is good.

If Zimbabwe was holding a substantial reserve of US dollars, the hyperinflation event they had could not have happened. Instead, the government looted the treasury or bank of valuable currencies (US dollars) to buy expensive Mercedes cars, etc. Eventually there was nothing to back the Zimbabwe fiat currency and presto.

We often read worries the US will experience hyperinflation. The only way this can happen is if foreign countries lose faith in the US $ to such an extent that nobody wants to accept them in trade.

You can see then, if the US suffered a hyperinflation event, a whole bunch of country’s currency systems would disappear into hyperinflation at the same time.

I don’t think hyperinflation is necessarily the issue. The issue is whether the US has an obligation to reduce inflation in other countries, including the major economic trading partners who do not need special consideration.

Or, put differently, it may be better for the US and others to bolster relief funds in fragile countries instead of changing course on monetary policy.

I didn’t intend to suggest I believe there is a risk of hyperinflation in the US. I was just illustrating how it happens.

Other policy considerations such as relief may indeed be excellent options, although probably impossible to implement given the US political situation amongst others.

I’m in no position to be prescriptive. One of the problems with current economic models is they are so complex and potentially wrong or incomplete it is impossible to prescribe with any certainly.

Interesting line of conversation.

“I’m in no position to be prescriptive”

The IMF certainly is! Enjoyed the discussion too.