Introduction

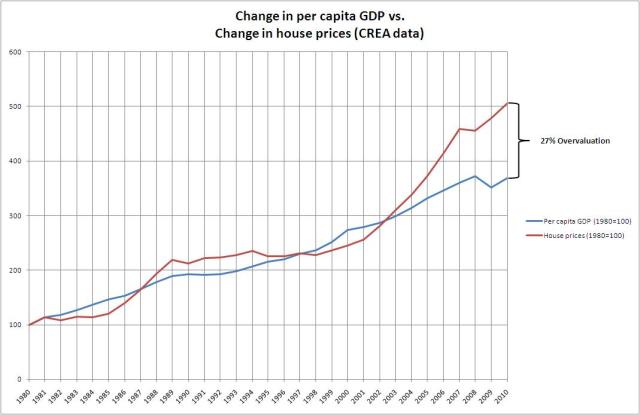

I recently highlighted the fact that aggregate Canadian house prices appear to be significantly overvalued relative to GDP per capita (one of the key determinents of income….all things being equal, higher income levels should equate to higher house prices).

Here are the key charts from that post:

As several of my readers have noted, an examination of house prices in Canada at the national level may have implications for the broader economy, but it does little to reveal local variations in house prices.

This is certainly true. I have long held that our national housing bubble is inflated primarily because of a handful of markets and specific market segments. Nevertheless, I’ve been hesitant to predict that too many locales will escape unscathed given the widespread element of mass psychology. It’s hard to find a part of the country where housing is looked upon as anything other than a fantastic investment and a great store of value. Furthermore, the widespread credit excess caused by the loosening of CMHC mortgage insurance standards knows no Canadian boundaries.

So with that in mind I undertook the significant challenge of analyzing provincial house prices based on one primary determinant of fundamental value: GDP per capita. This was done by accessing provincial resale data from CREA, and population and GDP data from Stats Canada. Today we will examine BC east to Ontario. Tomorrow we will look at the rest of the eastern province with the exception of Quebec (apologies to my Quebec readers as their house price data is not recorded by CREA….I’ll see if I can get my hands on it, but it won’t be this weekend).

British Columbia

I’ll let the charts do the talking for BC:

I’m not sure that much else needs to be said about these findings. Not too many people would be surprised to learn that house prices in BC are exceptionally out of touch with economic fundamentals. Let’s move on to a finding that quite surprised me…

Alberta

You may recall that Robert Shiller, arguably the world’s leading expert on real estate bubbles specifically pointed to Alberta as a bubble zone. House prices have in fact risen substantially, but so too has GDP per capita.

Now what I want you to note is that in this case house prices have apparently lagged GDP growth for nearly 25 years, only to catch up in 2006. Let me suggest that this is quite likely a reflection of the starting point. Throughout long enough periods of time, we should expect gains in house prices to pace gains in GDP. When it doesn’t, it is far more likely a reflection of a skewed starting point. From 1981 to 1986, house prices lost 22% of their value as a pre-existing bubble popped. If in fact the 1981-1986 housing bust was the result of a pre-existing bubble and simply resulted in house prices realigning with GDP growth, it could be argued (at the risk of being accused of data mining) that a different starting point would be a better indicator of current over or under-valuation.

With that in mind, I advanced the starting point by 5 years, aligning it with the bottom in the housing bubble and with the bottom in the drop in per capita GDP as seen on the chart.

You can see that from this point, GDP and house prices track each other much more closely…..until the mid 2000s that it. I will leave it up to my readers to decide which chart tells the more compelling story.

Interestingly, when the average house price is plotted against average GDP per capita, it seems to confirm that there is a level of overvaluation based on historic norms, but perhaps not as significant as the second chart above.

Saskatchewan

Of all the Western provinces, Saskatchewan seems to be the most fairly valued, perhaps in part due to restrictions on foreign ownership of farmland until the regulations were loosened in the past few years. Yet once again we seem to have the same problem of house prices apparently underperforming GDP for 20 years. What is interesting is that Saskatchewan never experienced a significant boom and bust. Could it be that houses and land in Saskatchewan have managed to avoid the sort of “easy riches” mentality that is the hallmark of an asset bubble?

Even if we advance the data to look for a line of better fit, we note that by all accounts, Saskatchewan seems much more fairly valued. The best line of fit for the two data series begins in 1990 and then deviates markedly about the same time as other parts of the country, namely the mid 2000s.

Yet if we divide Saskatchewan house prices by GDP per capita, we note the following:

There may in fact be a small amount of froth in some parts of the Saskatchewan market, but by and large, it is much more fairly valued than other areas.

Manitoba

Manitoba is surprisingly bubbly….

Note that house prices significantly underperformed GDP for much of the 90s and yet there appears to be significant overvaluation at present. Advancing the data set to find a cleaner fit would only make the housing overvaluation that much more acute.

When house prices are divided by per capita GDP, the variation from the mean is particularly noticable.

Ontario

Once again, the bubbly level of house prices in Canada’s most populace province is hard to miss…

You’ll note the ‘bubble’ (centred over 1989) which led to a fairly painful housing correction in the early 90s followed by a decade of stagnant growth. Note the relative variance of that blip over current price levels.

It is perhaps even easier to spot when house prices are divided by per capita GDP.

Indeed it appears that if there is an east/west divide that separates the ‘bubble’ provinces from those more closely in line with their fundamentals, that line appears to be somewhere east of Ontario.

We’ll look at those eastern provinces tomorrow to try to get more of an answer…

Cheers for now,

Ben

You should include the standard deviation when dividing by the GDP… It would be interesting to see if we have hit 3 SD or not.

Compare

saskatchewan-house-prices-and-gdp-1990.jpg

and

saskatchewan-house-prices-and-gdp-1981.jpg

How can the lines cross in one and not the other? Is it not the same data set?

I don’t understand how that happens. Please explain.

Thx for the analysis.

They do cross over in both cases. What you are looking it is the cumulative change in two data sets. It shows the cumulative annual percentage change in GDP and the cumulative annual change in house prices.

You start with a random number (usually 100) then account for the change in the data set for the next year. If houses rose by 10% and GDP rose by 12%, the two lines would now be 110 and 112 respectively. If the next year houses rose by 8% and GDP by 6%, the new lines would be at (110 * 1.08 = 118.8) and (112 * 1.06 = 118.72).

In this case, the starting point can have a significant impact on the overall growth in the line.

Make sense?

You are doing some great work here Ben and it is adding a lot to the conversation.

You illustrate a problem we have run into over and over again. What is the period we are discussing? If we look at the DOW from 2000, it hasn’t done a thing, but if we move the time line up to last April, it has doubled in just one year. I believe that’s unprecedented.

Maybe we have to stop looking at the issue of whether or not we are just catching up or whether or not houses were undervalued some time thirty or forty years ago. Perhaps the only relevant question is, are houses in a bubble today and what is the relevant time span for a bubble to form?

For instance, in one of the articles Sams Mango references below, they show a chart where the CS index went from 100 to 206 between 2000 and 2006. They say that’s a bubble. Then they show that TeraNet has gone from 100 to 204 between 2000 and 2011. They say that’s a bubble? What if it had taken 20 or 30 years? What is the time span for a bubble? It took Canada almost twice as long as the US.

Clearly, we need some metric for talking definitively about bubbles. We need some common vocabulary about what a bubble is. Certain human behaviors exist during and after a bubble. Bubbles get irrationally exuberant and then there are huge consequences. Who would ever have thought Nortel would be gone? It was 33% of the TSE in 2000.

We are not just talking about normal cyclical corrections. If we can get a better grip on the definition of a bubble and its timeline we can then apply our economic analysis to that time line alone. Previous economic periods are probably not relevant.

I guess it boils down to this. Is the TeraNet index going back to 100? Where is it headed, what’s the time frame, and will it make us an honorary member of the PIIGS club?

Great analysis. I’m curious – the real estate industry contributes to GDP (obviously) and if its contribution is the same fraction of the total GDP over time then it wouldn’t effect your comparison. But here in BC it seems (I haven’t seen actual numbers) that the real estate and construction industries have seen their relative contribution to GDP increase over the last decade, as other industries like forestry and high-tech have declined.

So, do you think that large increases in house prices are increasing the per-capita GDP value? And if so, would plotting the GDP minus its real-estate component give a better comparison? It would certainly increase the spread between the two data series, but maybe it’s not a valid correction. Perhaps I’m a bit ignorant on how GDP is calculated but, taken to the extreme, if 100 people bought and sold billion-dollar houses to each other all year long then it would raise the per-capita GDP by quite a bit but it wouldn’t mean more of us could afford houses… (This is my prediction for Vancouver circa 2025 by the way).

When I worked as a branch manager for Royal Bank there were many key components to helping people with buying houses. Most notably the five following reasons as taught by my course instructor. ( Or, the five that I seem to remember as key components ) :

1) use of rental income

2) use of leverage

3) forced savings

4) appreciation in value

5) tax free capital gain

So when people are looking at buying houses in a market with an overvalued housing market, financially sauvy people will be far more shrewd. Whereas, people who are more interested in the time honored catch phrases when they buy a house, such as, its a waste of money to rent when you can afford a mortgage. Not everyone is sauvy but things are changing quickly in internet information seeking society. Stagnant sales and deal grabbing will become common place at the expense of less experienced or less knowledgable buyers and sellers.

So when we see huge gaps in prices to actual an actual ethical valuation of a home we can recognize that there is panic out there and caution need be the word of the day.

Doctor, “What seems to be the problem?”

Patient, “Doc, I’ve got the farts. I mean I fart all the time,”

The Doctor nods, “Hmm.”

Patient, “My farts do not stink and you can’t hear them. It’s just that I fart all the time. Look, we’ve been talking here for about 10 minutes and I’ve farted five times. You didn’t hear them and you don’t smell them, do you?”

“Hmm,” says the Doctor,

He picks up his pad and writes out a prescription.

The patient is thrilled “Great doc. This prescription, will it really clear up my farts?”

“No,” sighs the Doctor, “The prescription is to clear your sinuses. Next week I want you back here for a hearing test.”

This is wrong way to look at the dataset – you simply cannot look at GDP vs House Prices. It makes the assumption that GDP and Home prices are financed at the same rate since 1981. That is clearly not the case. If you don’t hold rates constant, you are just taking random data points and trying to find something.

For example, business borrows at 7% to finance GDP, House finances at 2.50% – of course the house leverage (output) will be HIGHER than GDP.

I work for a company with ROI’s < than INT RATE on mtg. Plus biz can gets 2-3 turns of leverage (debt coverage) vs a person going into the bank, getting 10-15X.

Take that data that you and take the Biz Rate of Borrowing – 5 yr posted interest differential and discount from 1981. Any time you have GDP financed at higher rates vs rock bottom rates to retail home buyers, you will see the spreads that you are calling "overvalued", but on a constant R basis, they are right in line or in some cases cheap.

I want to borrow vs a business or I want to borrow vs home, rates are different. Your data is ignoring that.

*Comment removed by admin. Posts containing personal attacks will be edited or removed in their entirety. Play nice!*

Can you explain what you mean by “GDP and house prices are not financed at the same rate”? Who finances GDP?

“I want to borrow vs a business or I want to borrow vs home, rates are different. Your data is ignoring that.”

You’re going to have to connect the dots here. Are you saying that this wasn’t the case in the past?

Ben is just copying the methodology used by Steve Keene to look at Australian prices. Steve Keene is very good at econometrics. So, on the surface, it seems fairly safe to duplicate his work with a Canadian data set.

I haven’t thought about this analysis from a cost of capital perspective so I can’t say I disagree with you, but the bright light hasn’t suddenly flashed on yet, either. I’m going to have to think about this.

I would like to hear more about your reasons.

So you are stating that the finance market thinks residential is much less risky than commercial. It is mostly because of government underwriting. The US found out this cannot markedly distort markets in the long run. Just saying.

Food for thought: do you think that all investors look for market financing when investing?

You are assuming that you can lock into the “affordable” rates for the entirety of the mortgage. This might be true in the US, but not here. Hence, House Price/GDP is a good indicator of the risks involved.

Mary Carney INBOX

http://www.marketwatch.com/story/housing-booms-in-canada-2011-03-28

http://www.emergingmoney.com/currencies/canadian-housing-bubble-could-hit-fxc/

http://www.dailymarkets.com/stock/2011/03/28/stock-market-two-biggest-fears-getting-closer/

http://www.totalmortgage.com/blog/housing-market-2/is-a-canadian-home-price-bubble-ready-to-burst/11318

http://wallstreetpit.com/69147-canada-home-prices-headed-for-steep-correction

Also you should highlight recessions in your graphs. If housing is creating so many jobs as you have stated GDP growth has been from housing, that percent you believe should be removed also for fear of double counting. Probably ok when divided

Great analysis, Ben. Many thanks.

What I fail to understand is that there is no evidence of sort any meaningful supply-demand imbalance that should undercut real estate valuation. Am I simply being dense?

Maybe it is too obvious that supply equals demand by definition? 😉

A few mkts in BC are woefully weak for this time of year. I suppose one can argue that is an imbalance, but nothing lower prices won’t fix.

I’m afraid I have to agree with food1. Sorry mango. Have a great day!

Maybe Sam’s post was an April Fool’s joke, because it sure doesn’t make any sense.

House price/GDP does have some faults. Look at Alberta. Because the oil sands are extremely capital intensive and so very important to Alberta’s GDP, GDP can be higher relative to housing, yet that doesn’t help the Timmie’s counterperson in Calgary. A lot less Albertans work in the oilsands, and a lot more in low paid service than you would think. Capital-intensive large business makes a wonderful contribution to GDP, but lacks the trickle-down.

Still useful as just one more way to look at it, and with complex problems multiple viewpoints are good.

I think this may also be the case in SK, to some extent. I understand the recent surge in GDP is primarily due to higher commodity prices (potash, oil, uranium, wheat, etc.). While there is definately a trickle-down effect (especially with farm reciepts) to the broader population, most of the bump is merely higher prices for similar volumes (although volumes are definately creeping up).

1. Plot interest rates since 1981. Look at the average vs. Spot

2 plot business rates vs home rates

3. When rates are so slow, what do expect these traps will show? Why don’t we see any huge kinks in 1989?

4 common mis understanding when using stats to over simply stuff from a macro level. However, the reason for these graphs is interest rates. Nothing more.

5. These graphs need to take the derivative and look at the rate of growth. Are we increasing at a decreasing rate and vice versa on both lines?

I will give more details as to why this wrong next week. But everyone should think about two things

What growth rate is acceptable from real estate? What is the current long term growth rate?

Review my points before attacking please

Define “long term”!

Thanks Sam/Mango

Can you explain what you mean by “average” vs. “spot” interest rates?

“However, the reason for these graphs is interest rates”

I don’t disagree. Interest rates are the second largest factor driving the current housing bubble. If I understand what you are trying to imply, you’re saying that the real estate market will maintain its buoyancy as long as interest rates remain at near all-time (and arguably artificial) lows, and that given current interest rates, houses are reasonably valued. Again, what does that mean when interest rates do rise?

With no disrespect intended, I’m not sure that the words you are choosing are conveying your desired message. I’ve re read your last post several times and I’m still having trouble making sense of some of your points. I’d like to hear more. But keep in mind that I’m a pretty simple guy. Can you break it down a bit more for me?

Simple

Rates go up, your housing line will go down. But at the same time the economy then would be booming and your GDP line would go up and they would find each other.

What I am again saying is that with huge differences from the average rate, I would except what you call overvalued to exist. If it didn’t, then you have something. But those graphs are normal and expected for the current rate world.

Sorry, to finish to normalize them is then what I was getting at in my first reply. If you had to hold rates constant or discount the graph for the same rate world. It will show nothing

For example. Hold a fixed payment constant in that life of graph. Say 1000 mtg money a month. At different points it gets you more or less house, currently it gets you ton more

I hope this helps

Thanks Sam/Mango

That’s what I thought you were getting at. I don’t agree that house prices are driven solely by interest rates. Loosening CMHC insurance requirements is probably the greatest factor that has inflated house prices. I would say that interest rates and mass psychology are a close 2-3.

All that being said, if we assumed that house prices have been driven primarily by interest rates, what does that imply about future prospects, as interest rates have only one long-term direction in which to move? I would also remind you that rising interest rates are not necessarily associated with a booming economy. The bond market needs only to get the jitters about buying government bonds at such low interest rates to drive rates back up.

Just looked through 15,000+ records of which banks used the Fed’s Discount Window during the financial crisis. This is the information the Fed really wanted to keep confidential as using the Discount Window is supposed to be embarrassing.

A veritable Who’s Who of the world’s banks used the Discount Window during the crisis, but no Canadian banks.

So, the Bank of Canada didn’t use the swap facility and Canadian chartered banks didn’t use the Discount Window.

Anyone want to suggest Canadian financial institutions were simply considered to be too weak to use those facilities?

50b went from banks to boc in a made in canada version. It was done at reasonable swap rate. It included overnight paper which then later became 15y paper. Bankers acceptance is whats it called here

TAF is the same as the discount window for collateral and financial strength.

http://www.federalreserve.gov/monetarypolicy/taffaq.htm#q3

Use of a secured facility doesn’t prove strength or weakness. I’m not sure why you think that their use of the TAF in rather large amounts but not the discount window makes them invulnerable. Perhaps you could clarify for me?

To put it another way, for a group of banks that do the substantial majority of their business in Canada, they sure used the Fed’s programs alot.

And to throw a strawman out there – scale their TAF use to the relative size of the US vs. Canadian economy, and they were bigger than Citi, JPM and BoA combined. (See late-Nov/early-Dec 08 from FOIA 2009-73/106, Category 4 – there’s only one file)

Gee, sure sounds like trouble if I throw in the $50bn from CMHC, as Mango points out. That’s what happens when one doesn’t look at the entire picture.

Again, doesn’t prove that Canada was different than anyone else. I’m of the view that _every_ major bank would have failed without the emergency programs – the system is just too interconnected with short term funding needs to have delivered any other result. In hindsight, it should have been a given that whatever needed to be done would be done.

The Royal Bank has 2/3 of its assets in Canada. That’s a majority, but the word substantial is subjective.

Check out what LIBOR was during the period you refer to. The TAF was set up because inter-bank lending had frozen up. Tell me that Canadian bank’s cash needs were different during this period from any other and you have an argument.

Check out the stock performance of RBC, TD, or BMO over the past five years, and particularly over the period from Sept ’08 through Sept ’09. They track the DOW, not the financial crisis. Compare them to GS or JPM. Heck, compare them to Citi. Goldman Sachs has returned absolutely nothing over the past five years (unless you are an employee), but RBS is up 50%.

Canadian bank stocks performed as or better than the markets generally, far outperformed American banks, did not respond to the financial crisis, did not stop paying dividends, but you claim they would have failed if it were not for a tax payer bailout. I’m surprised this isn’t an election issue.

And just so we set the record straight, CMHC did not bail out the banks to the tune of $50B. Banks sell their loans in the normal course. If there is no market for their loans, they stop making them. See the United States of America for an example.

The Canadian government, through CMHC, made sure there was a market for Canadian mortgages, pure and simple. There is a big difference between making sure there is a market (being a “market maker”) for Canadian mortgages and bank failure. CMHC didn’t bail out the banks, they bailed out Canadian home owners. There is no other way to look at it.

Perhaps you have forgotten what happened to Asset Backed Commercial Paper in Canada during the same period. The Canadian banks were the market makers for ABCP except during “extraordinary market disruptions.” With no federally mandated market for ABCP the banks backed off, as was their right and their duty to their stock holders, and the ABCP market came to a grinding halt.

I think the picture may be a heck of a lot bigger than you know.

I think we probably agree more than it seems. You’re say:

Tell me that Canadian bank’s cash needs were different during this period from any other and you have an argument.

They’re not any different, and that’s my point. Everyone needs funding, and they’ll take it where they can get it. Without it, they’re dead in the water.

Not sure why you bring up equity market performance – in this context, it doesn’t address the question of funding. But if you want tickers, JPM and WFC track RY from Sept 08 through 09. Over 5 years, ex-fx, RY outperforms JPM by 10%, and WFC by 20%. Not insigificant, but hardly a massive outperformance by my standards (I’m more of a smallcap person, so I’m used to much larger swings and gaps).

I’ll stick with your example, RBC. At the end of 2008, on BS assets in Canada were 4.3x that of the US. Off BS were 2.7x. That strikes me as being a substantially Canadian (as opposed to balanced) bank.

And note, I don’t characterize the CMHC $50bn as a bailout, but as a liquidity infusion. I wouldn’t call it a bailout because it wasn’t a permanent injection of equity or quasi-equity (my definition). It kept the system going when it had a liquidity, not solvency issue. But let’s not claim something of this scale was in the ordinary course of business. If you believe it is, please show me another example of a $50bn deal like this in Canada from a government buyer.

Let’s work down your reasoning – it kept the RE market going. Agreed. But it also kept everything else going as well. Banks don’t loan out mortgages to borrowers, they lend cash. When you withdraw $20 from an ATM, you don’t get a torn corner of a MBS, you get a $20 bill. If you can’t do that, you get a massive run on the bank and go down for the count, regardless of your asset quality.

This is the ABCP issue you mention, scaled up. Again, not claiming that without CMHC deal, the Cdn banks would have failed, but it certainly gave them a lot more headroom in an environment of uncertainty. And doesn’t make them any different than any other bank around the world where their hedging counterparties suddenly defaulted, short-term funding dried up and there was a massive derisking both within and outside the financial system.

Do you honestly believe that if every bank in every country around the world failed, with the knock-on effects in the business world, none of the Canadians would have had a problem?

Except the Bank of Canada officially renewed a swap, indicating fairly clearly that there was a swap to be renewed.

Someone is lyingobfuscating!The Bank of Canada and the Federal Reserve have agreed to re-establishment of the US$30 billion swap facility (reciprocal currency arrangement) that had expired 1 February 2010.

http://www.bankofcanada.ca/en/notices_fmd/2010/notice090510.html

Also there is a central bank redacted on the released documents. Much speculation on Zero Hedge and elsewhere that it is the BOC, they are the only likely one missing from the lists. And let us not forget that Mark Carney is a Goldman alumni!

It is the BoC that is redacted on the Zero Hedge release. Any bank that has no transaction in the report is redacted for some reason. The only transaction the BoC had is reflected on pages 250 and 251. BoC follows BoJ. Zero Hedge loves a conspiracy, but this isn’t one.

I found the data for Quebec.

http://www.fciq.ca/immobilier-statistiques.php?lg=en

and

http://www.fciq.ca/immobilier-barometres.php

I haven’t played with the tables yet. If you need a very quick graphic, you can check in the last quarter’s barometer, it has a graph for the SFH from 2000 to today.

And even if the exercise to look at provincial data is better than federal, everyone that says “it’S different here” will say “looking at data for the province is not enough, the market is local”.. then you do stats locally and they’ll tell you it depend on the street.. then on the actual house, etc.

There is no argument to be won with people saying it’s different here. Yesterday I had dinner at my spouse’s parents and he’s a realtor. You can imagine that I had to avoid touching the subject as we are renting, looking for a rental and refusing to buy.

Thanks Etienne. There’s not much I can do with that data for now since it only goes back to 2005. I’ve sent an email requesting the historic data. I think I should be able to get my hands on it. Give me another week or so.

I’ve emailed to know back to when their paying reports are (they are 10$ each plus 50$ setup).

Alsom, if you look at the bottom right of page 5 of this document: http://www.fciq.ca/pdf/Barometre_MLS/BAR-2010-Q4-PRV_AN.pdf you can get a graph from 2000 to today, but only for SFH.

Pingback: VR View – Worthwhile Links (April 5 2011) » Valdao Reputo (VR)

Pingback: How important is construction to economic growth and employment across Canada?: Part 1 | Financial Insights

Pingback: How important is construction to economic growth and employment across Canada?: Part 2 | Financial Insights